Keep this story going! Share below!

Datamaran improves responsible business practices and increases sustainability disclosures by integrating materiality analyses into corporate strategy. By automating resource-intensive processes and embedding non-financial risk management across all business functions, the AI-powered software helps corporate decision-makers to identify and manage ESG-related issues such as plastic pollution or human rights.

Taking a more holistic-based approach to risk management in business operations and enabling greater transparency in reporting can accelerate progress towards responsible consumption and production globally.

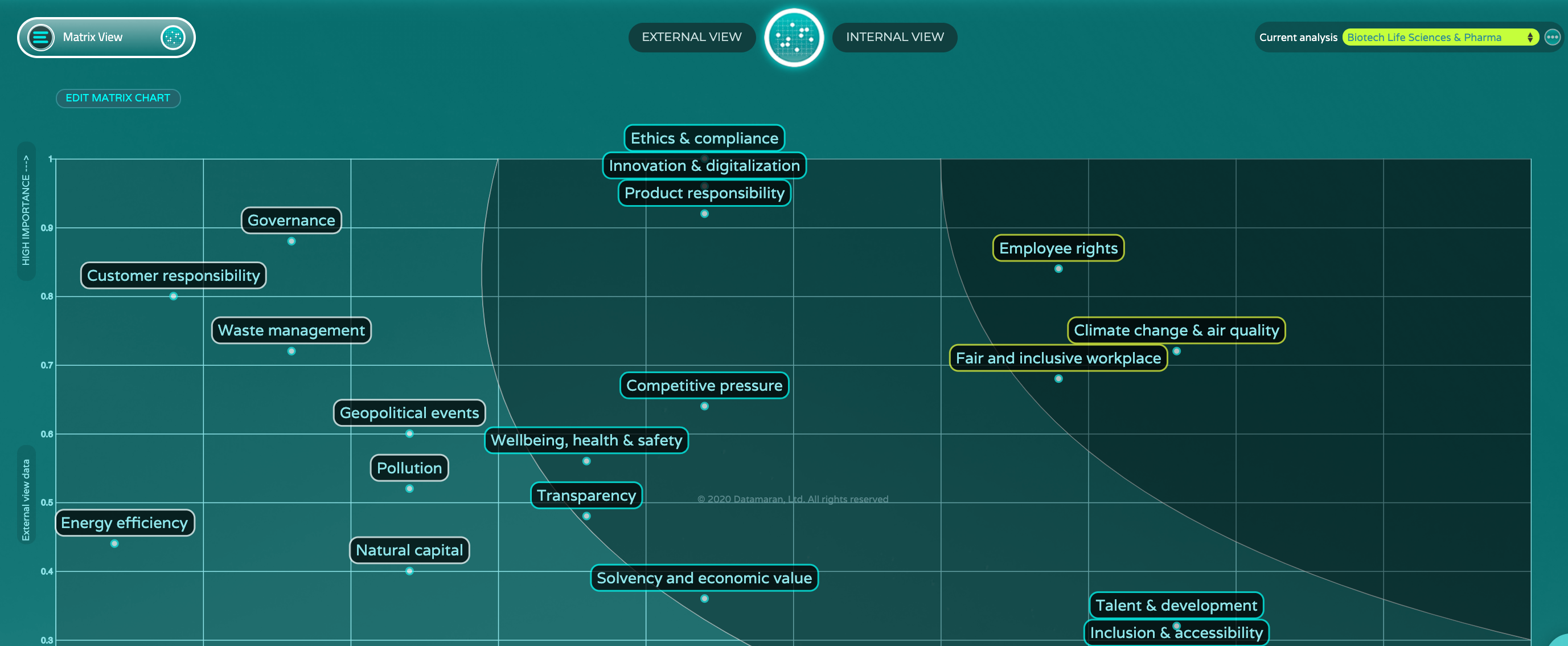

Datamaran leverages Big Data and Artificial intelligence (AI) to efficiently track and monitor ESG-related topics across the combined regulatory, corporate, and public landscape worldwide. Based on Natural Language Processing (NLP) technology, the AI-engine allows users to effectively analyze millions of data points from corporate reports (financial, sustainability reports as well as SEC filings), mandatory regulations and voluntary initiatives, news and social media in seconds. The advanced digital software provides companies a more robust and credible process to conduct their materiality assessments by enhancing stakeholder voices and integrating both qualitative and quantitative information into the analyses.

Datamaran's comprehensive database empowers sustainability councils, boards, and other business units with a more evidence-based approach to strategy planning. The platform's up-to-date monitoring capabilities enable users to complete more frequent and timely analyses, capturing decision-useful information in a fast-changing environment. Business leaders can easily and effectively leverage Datamaran's data-driven results in the design and implementation of their sustainability goals. In effect, the platform extends the focus of ESG and non-financial issues beyond reporting or communications purposes into business impact and operations.

With little time and few resources, Datamaran helps companies manage nonfinancial issues and enhance stakeholder voices.

Sustainable value creation is what led co-founder, Marjella Alma, originally the head of New York office of the Global Reporting Initiative, to partner with a former Wall Street trader to leverage AI into corporate sustainability efforts - changing the business game and driving her vision into reality.

Curiosity is what brought Donato Calace, Datamaran’s VP of Innovation and Accounts, to join this leading risk management firm and global community of forward-looking business leaders. Originally from a world of academia where he completed his Ph.D. in Economics and Natural Resources, Donato remains a prominent figure in the EU regulatory landscape; focused on the dynamic processes of materiality, as well as the evolution of environmental, social and governance (ESG) disclosure standards in corporate reporting.

Donato has published an academic paper, Materiality: From Accounting to Sustainability and the SDGs, wherein he refines the concept of materiality and underscores how it can help to achieve prosperity for all. He outlines how there are "major impacts that material issues have on the financial, economic, reputational, and legal dimensions of a company, as well as on the system of internal and external stakeholders of that company."

As we transition from shareholder primacy to stakeholder capitalism, these words may never have rung more true.

Datamaran helps companies in addition to partnering with organizations such as the Sustainable Accounting Standards Board (SASB); the consulting firms Environmental Resources Management (ERM) and Ernst and Young; the NASDAQ and the London Stock Exchange to help advance disclosure and build a more resilient capital market system.

Consumer goods and product companies have used Datamaran's materiality insights to highlight the transition away from traditional operations towards business models based on circular economy principles. Transnational basic material companies with global footprints utilize the platform to understand the risks of environmental impacts beyond reputation for cost-reduction strategies including energy efficiency or waste management practices.

Finally, Datamaran has made its platform available to top universities in an effort to increase access and provide next-generation leaders with the tools they need to create a positive impact in business.

Small and large companies are under pressure to provide an increasing volume of data on a range of financial and non-financial issues. Meanwhile, different stakeholders including investors, regulators, and consumers have varied expectations about how and what information is published.

Datamaran is featured in a number of leading corporate reports, trusted by companies including Unilever, BASF, American Electric Power, Chevron, and Phillips Conoco. Cutting-edge platform's like Datamaran are fair complements to human intelligence and activities, accelerating further the prioritization of ESG issues beyond reporting into corporate strategy.

Datamaran's global team of data scientists as well as sustainability, risk and legal experts, support business leaders in a world where information can be shared rapidly and widely - so helping companies that are vulnerable to a myriad of legal, reputational, and political risks.

Small and large companies worldwide use Datamaran’s evidence-based and dynamic approach to develop and inform their materiality, risk management, and reporting processes. With Datamaran, corporate sustainability folks can save time, cut costs, and gain confidence in their strategy.

At Datamaran, the team aims to improve corporate disclosure in an effort to build transparency and ameliorate harm to people and the planet. Research suggests a correlation between a company's non-financial disclosure content and its management of ESG-related issues. In other words, non-financial reporting is one indicator of how a company is, or is not, managing its environmental and social impact.

The AI-engine automates processes that would otherwise take time and resources, so removing some of the burdens off of sustainability leaders to identify and report ESG issues. As a result, this allows time and energy for corporate leaders and sustainability professionals to focus on managing those non-financial issues. Put simply, Datamaran equips leaders with the tools to quickly identify and monitor non-financial issues, meanwhile providing auditable reports to build the trust of external stakeholders.

Get stories of positive business innovations from around the world delivered right to your inbox.

Traditional corporate sustainability and risk management strategies are incomplete and outdated. While some risks are simply unknown, others, like environmental, social, and governance-related (ESG) risks, are rather difficult to identify, measure, and respond to effectively. Current methods like manual data analysis, limited surveys and ad hoc consulting make sustainability efforts using holistic-based processes more challenging.

At Datamaran, a global team of risk management and reporting experts, in addition to data scientists and sustainability consultants work hard to provide business leaders with the tools and insights they need to not only monitor ESG risks but manage them to achieve corporate responsibility goals.