Keep this story going! Share below!

Caspian Debt has sponsored more than 150 start-ups and businesses during the last 15 years since our founding, taking into account both their loan and equity needs in the fields of financial inclusion, renewable energy, Agri-Technology, and other sectors. They are considering the upcoming stage of growth and expansion.

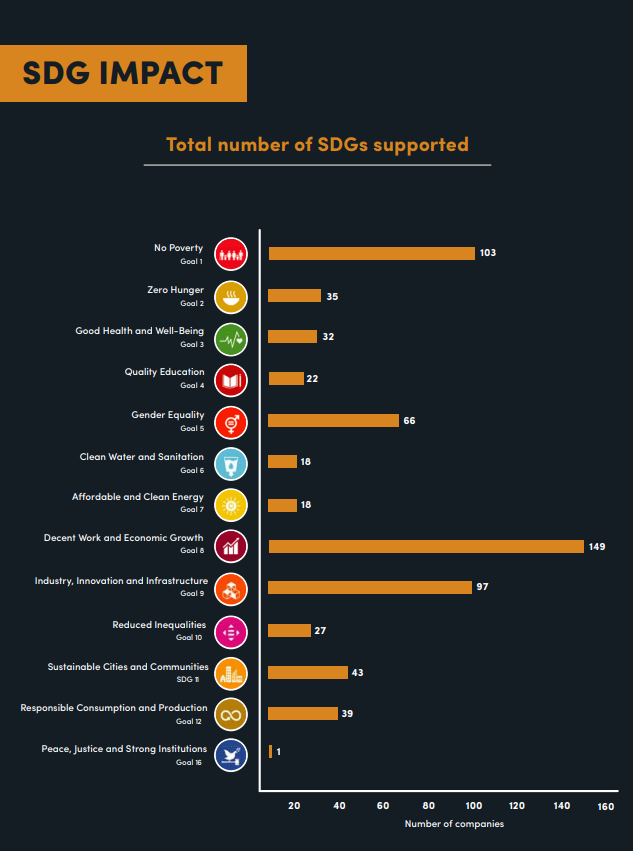

Their portfolio firms have influenced 13 SDGs (sustainable development goals). Caspian Debt invests in Education, Livelihoods, Drinking water and sanitation, Clean Energy, and Healthcare. They also enabled financing for healthcare enterprises tackling covid during the second wave.

Some instances of impact investing by Caspian Debt include- Companies working on plant disease detection, improving water use efficiency, and using satellite imagery and infrared rays for soil testing (testing the magnesium level in the soil).

Startups tend to fail due to a lack of innovation and financial crunch as they may not have enough experience in business handling. Therefore, in today's world, it is very cumbersome for a startup to get loans from commercial banks. Caspian debt bridges this gap by providing loans to startups looking forward to achieving certain SDGs and also having a good forecasted growth map. Caspian debt provides finances to companies that cannot easily avail of loans through banks without collateral. They take into account the growth perspective and the purpose of the company. Once they grow into a flourished company, they can easily pitch for financial aid without Caspian Debt's help.

This helps create a positive impact on the world by considering social responsibility as the need of the hour. It allows small businesses with innovative solutions to pave the way for their growth.

First-generation entrepreneurs with strong academic backgrounds and/or professional experience found the transformational businesses we support. They founded these businesses with the goal of resolving pressing social and environmental issues. These businesses operate commercially. Businesses that are viable and built for growth typically raise outside money to expand. These businesses have credit needs in the $0.5 to $2 million range, but they are unable to receive standard bank finance because they lack the mortgage collateral. Due to a variety of factors, retail MSME fintech lenders, banks, and even venture lenders are unable to satisfy the financial needs of such businesses. Their main priority has been to close this credit deficit. The inspiration behind Caspian was to formulate an impact investing firm which has a motive of providing capital but growth for the companies also lies beyond capital.

As Emmanuel sir pointed out that banks might not be in favour of funding the new age startups and entrepreneurs as they do not have the capacity to do small loans since it involves a lot of due diligence and to bridge this gap of funding budding entrepreneurs who are still in the process of thinking what they are going to do, Caspian comes into the picture. He also shared that many of the startups do not have a credit history, do not belong to a business family, inability to offer collaterals, such startups do not get bank finance and that is why they come to Caspian.

Trying to understand Emmanuel sir’s motivation behind being a part of this vertical he said that Impact Investing is a very new evolved term. The transformation of the country and the betterment of farmers are two of the many reasons he has been a part of this sector for a very long time. Impact Investing, according to sir, is a very straightforward thing which thinking beyond the returns.

After a fruitful discussion with one of the Investment director and member of the credit committee of Caspian, Emmanuel Sir, who is currently a veteran in Impact Investing and a fund manager of Caspian’s Equity new Fund LeAF which invests in early-stage Agtech start-ups, some of Short Term and Long-term goals of the Innovation Caspian is providing include -

1. Increased women's participation in the workforce

2. Reducing Drudgery in Agriculture

3. Making Agriculture attractive for the next generation

4. Aim of the equity fund is to solve or invest in businesses that are solving larger problems, for instance, funding companies that are supplying hand tools which are basically the small tools substituting the labor force.

5. Solving problems for the companies at the bottom of the pyramid to scale and at the same time have an impact say to impart education to low-income families, improving livelihood, easily accessible healthcare facilities to the marginalized population etc.

Source: Caspian Debt website

Some of the other long-term and short-term effects that Caspian as an impact investing firm could enforce are as follows –

1. Creating a positive impact to build a better world

2. Creating an Environment for Organizational Excellence

3. Ambition to provide debt to companies that are likely to grow in a responsible, sustainable, and transparently. Provide loans that might enable the growth of their portfolio companies, growth which is beyond the capital, including community and connect.

4. Lend to companies that have a positive and social impact on society or the environment

5. Commitment to non-financial impact

Evidence can be seen through the following -

1. The first Indian impact investing firm to get a B-Corporation certification

2. Served 13 SDGs

3. 140+ Companies funded

4. Rs. 2000+ crore amount invested

5. Caspian Equity has completed 21 investments, with 16 still existing with 2 IPOs

6. Created 45000 jobs

7. 19.43 Million clients impacted

To fulfil the credit demands of the group of businesses they support, where professionals manage operations, they have developed a scalable solution. To achieve this, creativity was required in three areas: operating structure, funding sources, and loan distribution strategy, and that has been the ongoing focus of their work. When evaluating a company's credit, they place emphasis on its fundamental business potential and work to determine whether it has the financial wherewithal to repay the debt according to a predetermined payback schedule. This substantially differs from how traditional lenders are typically understood to evaluate collateral. Additionally, they employ a range of financial instruments, which are tailored to the requirements and risk profile of their investees, including term loans, revolving limits, purchase order or receivables finance, subordinated debt, venture debt, and guarantees. Last but not least, it has been the long-term vision and commitment of their investors and partners to help them build a high-quality, resilient and durable fund vehicle that fills this crucial funding gap that has given them the freedom and flexibility to choose credit quality over exponential growth and measured diversification over-aggressive expansion. Through a range of financial instruments like equity, debt, subordinated debt, and credit upgrades, their investors support them. They also collaborate on knowledge projects with banks, incubators, accelerators, and supporters of the startup ecosystem. Customized credit is minimal risk, in their opinion. Their portfolio has been meticulously curated, combining equity-like due diligence, unique structuring, risk management through close monitoring, and sectoral diversity, with loans ranging from USD 140,000 to USD 2 Mn (INR 10 Mn to INR 150 Mn). Their credit rating even during the pandemic is evidence that their plan has thus far been successful. This way, Caspian benefits the businesses it invests in and the stakeholders which are tied to it.

Emmanuel sir shared about the employees of the company. The company looks for young people with excessively high energy who push their frontline staff to do all sorts of things and to chase targets. Caspian Employees are the people who have a serious heart in the right place for impact. The people who are team players and not just individual superstars. Self-driven people who are hard-working and work even if there are no everyday review meetings and is clear about his/her targets which he/she delivers by the results. The person has good analytical skills and is an independent driver to work. Caspian also has a very good work-life balance for its employees. Currently, the organization has 51-200 employees.

To talk about Caspian in numbers –

Caspian Debt – 1. 8 years in existence with 51000 jobs supported

2. 205 Investee companies involved

3. Rs. 2300 crore in debt disbursement

Caspian Equity – 1. 21 Investments with 16 still existing and 2 IPOs

2. 45000 jobs created

3. 19.43 Million clients impacted

Caspian exists to create a positive impact and articulate and measure it to evaluate how their capital can help address pressing social and environmental problems. The Caspian Debt is modeled to be a specialized lender for early and Growth stage SMEs. Our experience allows us to identify and manage risks associated with investing in such businesses. Their primary impact lens is a sectoral one. They work in sectors with high potential for developmental impact and prefer clients working with low-income households or women or contributing to environmental sustainability. They select “Positive Impact” business models and apply prudent Environmental, Social, and Governance (ESG) filter to onboard customers.

Some of the projects that Emmanuel sir mentioned includes -

1. INA farms solving the problems related to quality, traceability problems, seasonality requirements etc. This can be solved if you have a better farmer and connect with the processing unit. This company help us in getting better farmers by advising farmers when to irrigate, weather conditions information and advising preventive actions basis weather forecast like preventing use of pesticides etc.

2. Funding companies that are solving farmer's finance who are not able to easily get credit to meet the requirements of working capital as agriculture is a seasonal thing, three months a farmer works and three months wait for the harvest to be ready. So focus is on startups that provide finance direct to the farmers.

3. Companies working for insurance of the agriculture and providing cover to the farmers and stabilize their income.

4. Startups trying to reduce the inefficiencies in the supply chain etc.

5. Startups making small hand tools for farmers that will help reduce drudgery and substitute labor

Get stories of positive business innovations from around the world delivered right to your inbox.

Caspian is the first impact investing company in India to receive a B Corp certification. Caspian makes investments in businesses that tackle issues with efficiency and accessibility in commercial ecosystems that have a good social or environmental impact. The company aim to apply knowledge of early-stage companies operating in this field and contribute resources and experience to enhancing reach and viability. Caspian Debt's goal is to foster the development of businesses that aim to have a positive social and/or environmental effect in a responsible, transparent, and sustainable manner.